June 2024 Market Report

Despite a wall of worry – higher interest rates, persistent inflation and ongoing geopolitical uncertainty – markets proved resilient in the June quarter. The period also marked the end of the 2024 financial year in Australia, with the vast majority of asset classes achieving positive investment returns.

Mid-Year Takeaways

Fickle forecasts

At the beginning of the financial year, the overwhelming economic consensus was for rate cuts in 2024. Fast forward nearly a year, and the prospect of rate cuts is nearly zero. In fact, there is an even chance the Reserve Bank of Australia (RBA) may need to increase again. Meanwhile, central banks in Switzerland, Canada and Europe have already begun loosening monetary policy. It’s a reminder forecasts are an educated guess rather than fact.

2. The opportunity cost of cash

The rapid rise of interest rates across the developed world has meant for the first time in over a decade, investors can earn meaningful returns on term deposits and cash-like investments. For those approaching or in retirement, this has been a welcome reversion back to the mean. However, it has also highlighted the opportunity cost of reallocating capital into safe assets and the returns investors may forego by doing so. To illustrate, domestic equities have returned 12% in FY24, while the United States equity market increased 24%.

3. Time in the market

As we touched on in the introduction, the 2024 financial year was dotted with events that would typically be described as “negative” for investors. However, the overwhelming majority of asset classes posted robust returns, highlighting the importance of remaining fully invested and regularly contributing to your wealth.

Economic Update

Inflation has settled above the RBA’s target band of 2-3% with market participants concerned further rate hikes will be required to avoid another inflation spike. In May, the monthly Consumer Price Index reaccelerated to 4.0% underpinned by rising housing, health and transport costs. Notwithstanding cost of living pressures and low consumer sentiment, Australians are for the most part weathering higher prices well, supported by robust employment numbers and wage rises. Moreover, high levels of immigration and a housing supply shortage have underwritten an 8.0% increase in national dwelling prices - with homeowners feeling wealthier as a result. The RBA has so far kept the cash rate at 4.35% but commentary has shifted towards a more hawkish stance.

“Inflation is easing but has been doing so more slowly than previously expected and it remains high.” - June Monetary Policy Statement

In contrast, the global economy has largely managed to quell inflation pressures. Central banks are conducting or signalling rate cuts, albeit with the caveat that inflation needs to remain muted. Economic growth, particularly in Europe and the United States, remains tepid however central banks remain will be cautious about cutting rates too quickly in case inflation returns.

Asset Class Returns

Equities

S&P/ASX 200 | June Quarter -1.0% | 12-month +12.10%

SP 500 | June Quarter +4.3% | 12-month +24.6%

MSCI AW | June Quarter +2.9% | 12-month +19.4%

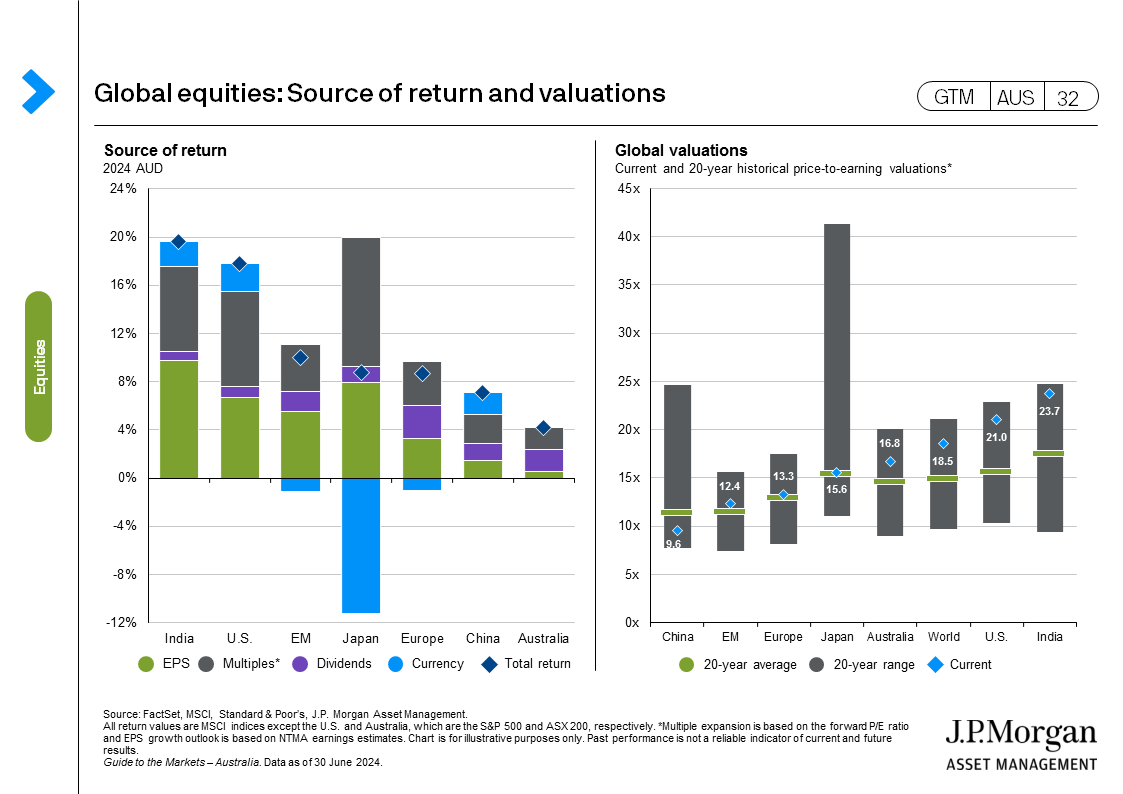

Australian equities retraced marginally in the June quarter. Still, the S&P/ASX 200 benchmark gained 14.78% over the past year led by the strong performance of the real estate, financial and technology sectors. The big banks led the charge with all four posting returns of at least 25% before dividends for the full year. Much of this was due to multiple expansion rather than earnings growth, indicating this year’s gains may not be repeated in future periods.

Source: JPM

Similarly, international equity markets rallied with indexes in Japan, India, the United States, the United Kingdom, Australia and Germany all reaching all-time highs over the past 12 months. As a result, valuations are beginning to look stretched on a relative basis. Companies exposed to artificial intelligence remain the primary driving force, with 60% of the SP 500 returns in the past six months attributed to just seven companies – Amazon, Apple, Meta, Microsoft, Tesla, Alphabet and NVIDIA. The magnitude and concentration of these returns highlight the benefits of diversifying capital across domestic and international investments.

Cash and Fixed Income

Bloomberg AusBond Bank Bill Index | June Quarter +1.08% | 12-month +4.37%

Bloomberg Global Aggregate TR | June Quarter -3.39% | 12-month +0.59%

Australian Government 10-Year Bonds continue to zig-zag between 4.0-4.5% as uncertainty lingers over which direction the RBA will move next. From a global view, supportive economic settings of falling inflation, strong corporate earnings and limited defaults have led to outperformance in investment grade and high-yield bond markets. Geopolitics are also having a greater impact, evidenced by the French bond yields rising in response to a snap election (French equities also fell 6.4% in June).

Currency

The AUD rallied strongly in the June quarter with the Trade Weighted Index increasing by 3.58%. The renewed strength in the local currency is primarily a result of other developed market central banks cutting interest rates and therefore making the interest earned in Australia relatively more attractive.

Source: Reserve Bank of Australia

Commodities

Gold has gained nearly 22% in FY24 and continues to march towards new highs with Macquarie forecasting the spot price will reach a quarter peak of US$2,500 in the second half of the year. Investors and central banks are amassing the precious metal as a safe haven to hedge against burgeoning fiscal budgets. Oil finished the quarter flat after OPEC+ announced it would extend production cuts into 2025, however it did not specify to what extent. Iron Ore rallied 11% in the quarter after China announced measures to support its domestic real estate sector.