Financial Advice Changes for FY25

The beginning of the new financial year brings several changes to taxation and superannuation.

Below we detail the main changes our advice clients need to be cognisant for the new financial year (FY25) beginning 1 July. As always, if you would like to discuss the updated legislation in more detail, please give your adviser a call.

Concessional Contributions

Concessional contributions are “before-tax” and include salary sacrifice payments, superannuation guarantee and contributions where a tax deduction has been claimed.

As of July 1, the concessional contribution cap will increase from $27,500 to $30,000.

You are eligible to “carry forward” contributions from up to five previous years if you had a superannuation balance of less than $500,000 in the previous financial year.

2. Non-concessional Contributions

Non-concessional contributions include contributions you make from your after-tax income or personal contributions you have not claimed a tax deduction for.

As of July 1, the non-concessional contribution cap will increase from $110,000 to $120,000.

You are eligible to “bring forward” 1 or 2 years of your non-concessional annual cap from future years depending on your total superannuation balance.

3. Superannuation Guarantee

From July 1 the superannuation guarantee will increase from 11.0% to 11.5%. This means your employer will be obligated to contribute extra to your superannuation for the new financial year.

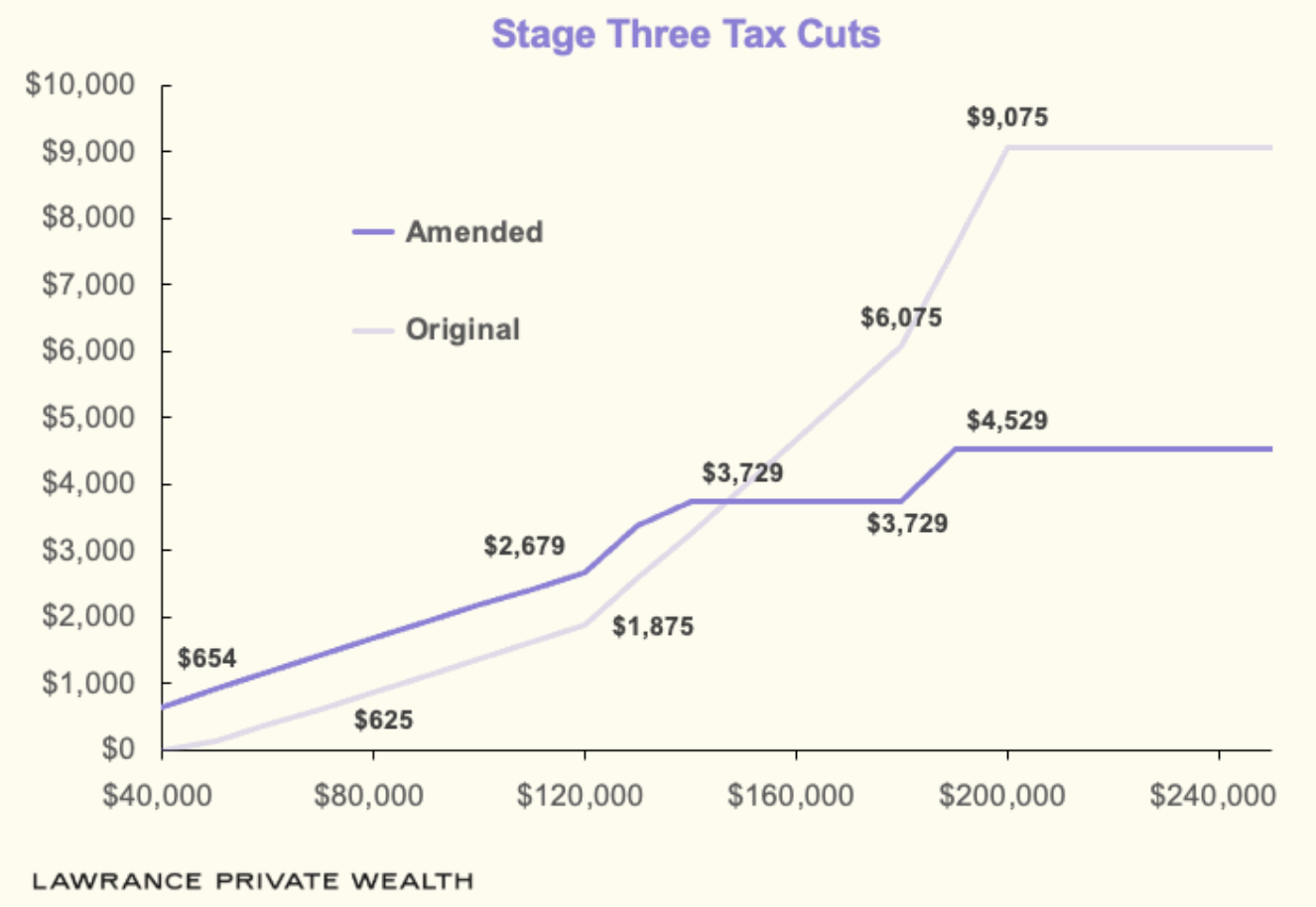

4. Stage Three Tax Cuts

From July 1 new individual marginal tax rates will apply to income earned in FY25. To determine how much you will save from the updated tax rates, check out our complete Stage 3 Tax Guide with all the information. In summary, the new marginal tax brackets are:

Upto $18,200 - 0%

$18,201 to $45,000 - 16%

$45,001 to $135,000 - 30%

$135,001 to $190,000 - 37%

$190,001 and over - 45%

This may impact the effectiveness of your existing financial strategies so it’s best to review them with a trusted adviser.