The 2024 Year in Review

Despite a soft final month of the year, risk assets including bonds and equities recorded impressive returns in 2024. The Fed cut interest for the third straight meeting, with the RBA soon to begin its cutting cycle.

Global Markets

Both equities and fixed-income securities finished the year softer, weighed down by a shift in rhetoric from the US Federal Reserve. The central bank reduced interest rates by 25 basis points but revised expectations for future rate cuts. The Fed now expects two further decreases, down from four in September.

Chairman Jerome Powell announced the central had entered a new phase and would be “cautious about further cuts”. Subsequently, the S&P 500 fell 2.4%, as did European and Australian equities. US treasuries and more broadly international fixed-income prices also fell in response.

Data Source: Bloomberg, J.P. Morgan

Zooming out, equities delivered fruitful returns for investors in 2024 led by the US. Much of the gains were attributed to technology companies, most notably the magnificent 7 (Apple, NVIDIA, Amazon, Alphabet, Tesla, Microsoft and Meta), who accounted for more than half of the S&P 500’s 25% annual return.

The group appreciated 63% in 2024, preceded by a 75% rise in 2023. Artificial intelligence was the favoured investment thematic among the zeitgeist, with chipmaker NVIDIA alone surging 171%.

Global valuations finished the year in line or above historical averages, and therefore investors should assume more moderate equity gains in the year ahead. Bonds also recorded a positive year, as falling interest rates supported higher fixed-income prices.

Source: J.P. Morgan

The strong performance of equities and bonds shouldn’t be taken as a given. Several dark clouds, notably rising interest rates, lingering inflation pressures and geopolitical conflict in Europe and the Middle East hovered over markets.

Even the election of the mercurial President Donald Trump to a second term in office failed to dent market confidence – in fact, markets surged on the prospect of pro-business policies and deregulation. The key takeaway is to stay the course, remain invested and not overreact to potential or perceived market threats.

Gold was another standout, with the precious metal’s price appreciating 25.4% in 2024. Gold producers, particularly junior miners delivered exceptional returns. Investors, as well as central banks in emerging economies, bought up gold reserves as a hedge against geopolitical conflicts and the waning influence of the US Dollar. Commodities broadly however experienced a down year. Oil prices fell on sluggish demand and the prospect of higher supply from the US after the election of President Donald Trump. Iron ore, Australia’s largest export, declined in response to a slowing Chinese economy and anemic stimulus announcements.

Australian Markets

Like other developed markets, Australian equities retreated 3.2% in December on the revised outlook for US interest rates. Australian bonds however increased owing to the RBA indicating interest cuts could be on the horizon.

The cash rate remained at 4.35% for the ninth straight meeting, however in its statement the RBA removed the line stating it needed to “remain vigilant to upside risk to inflation” and instead replaced it with “the board is gaining some confidence that inflation is moving sustainability towards target”.

Subtle language changes may seem arbitrary, but it’s the central bank’s way of communicating to markets (and households) that the data is trending in the right direction to warrant rate cuts.

Also adding to the rate cut chorus was tepid GDP figures, which showed the economy had growth of just 0.3% in the September quarter and 0.8% for the past 12 months. On a per capita basis, GDP fell 0.2% for the quarter and 1.5% for the past year, meaning without population growth, Australia would be in a recession.

The other notable economic release was the federal government’s mid-year economic financial overview. The latest budget papers showed this year’s deficit would reduce slightly to $26.9 billion, however, the government expects larger deficits in the following three years.

Rising spending, attributed to both new commitments and existing (Medicare, education, public service) programs, means the nation’s bottom line will worsen by $21.7 billion over the next four years to $143.9 billion in cumulative deficits.

The budget deteriorates further when accounting for investments (which are not included in the underlying budget position) such as Snowy Hydro and the 20% reduction in student debts. Total debt is expected to surpass $1 trillion in 2025-2026 and the budget is not expected to reach a surplus until 2035.

More simply, the federal budget remains in a structural deficit. The government spends more than it sustainably earns despite abnormally high employment levels, record tax receipts for workers and near-high corporate taxes.

The budget surpluses achieved in the past two years were the exception - primarily the result of elevated commodity prices - rather than the norm. The growing public service – now representing more than 27% of GDP (a record high), risks entrenching low productivity and keeping inflation higher for longer.

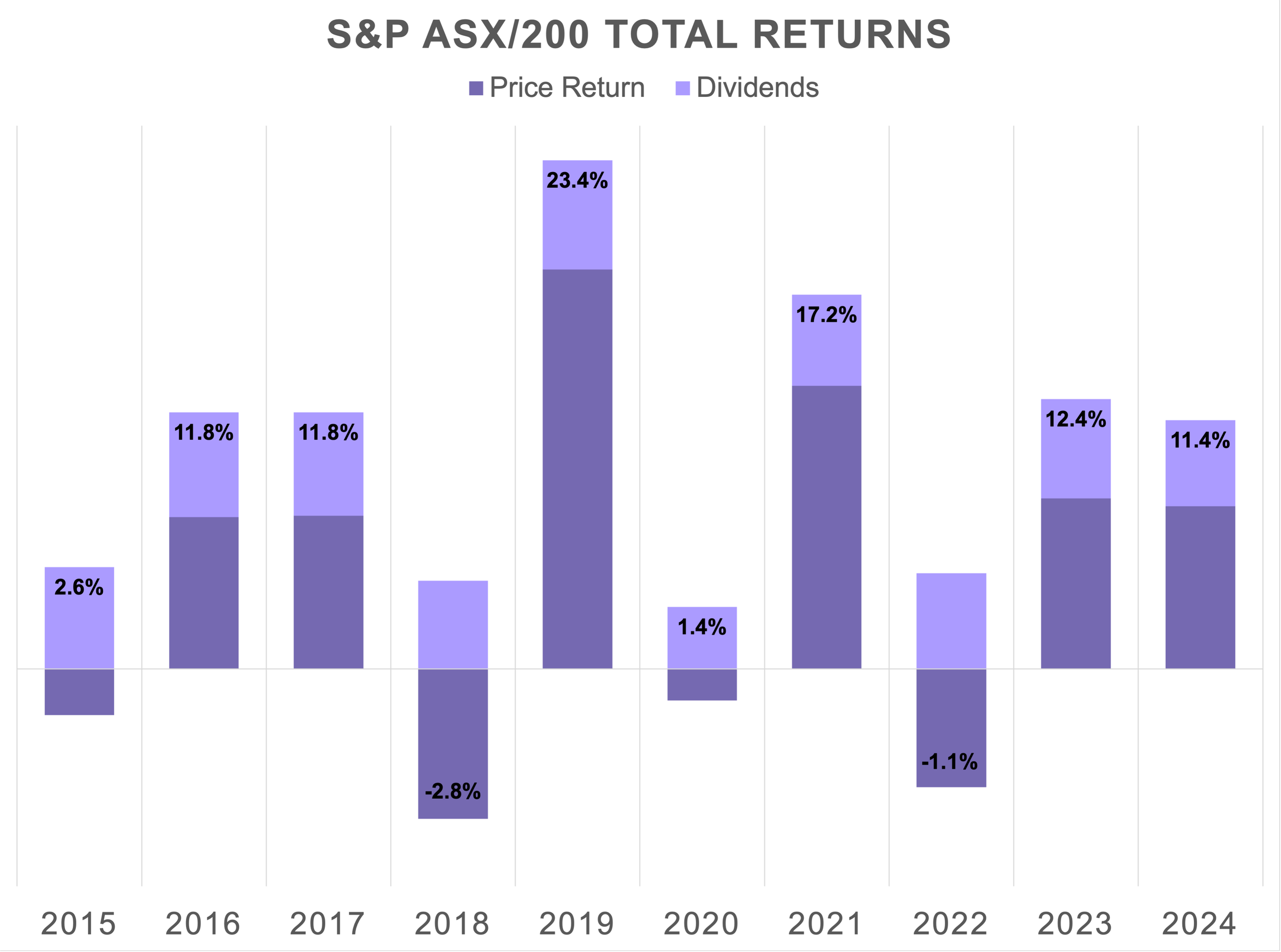

ASX Records Another Double-Digit Year

The local S&P/ASX 200 benchmark recorded a second consecutive year of double-digit gains, closing 2024 with a total return of 11.4%. Approximately 7.5% of this was derived from capital growth (increasing share prices), with the remainder from dividend returns.

Data Source: S&P Global

Beneath the headline index returns, there were significant performers and detractors. Technology was the best-performing sector, recording an annual return of 50%. Financials also had a strong year, eclipsing the performance of the resource sector by a staggering 50.5%.

The big four banks, led by Westpac and Commonwealth Bank, delivered an average total return of 33%. Interestingly, much of share price growth was derived from multiple expansion rather than earnings growth. For example, CBA’s share price increased 37% despite net profit falling 6%. This trend was exhibited across the overall index, with earnings per share falling marginally in 2024 but higher multiples more than offsetting the slump.

There are two main reasons for this obscure phenomenon. First, local superfunds continue to grow in size and because they are benchmarked against the index, need to maintain sufficient holdings of the largest companies. When markets rise, the superfunds need to buy more of the index, for which the big four banks represent four of the six largest constituents.

Second, there are relatively few high-quality companies to invest in locally, and therefore these companies trade on higher multiples than international peers. The largest technology in the index WiseTech is four times as expensive as Microsoft.

Data Source: Bloomberg

As for the laggards, the energy and materials sectors recorded negative returns. BHP fell 21%, Rio Tinto down 14% and Fortescue dropped 38% all fell in response to a decline in commodity prices and a slowing Chinese economy. Iron ore exceeded US$140 in January however finished below US$100 for the year. The lithium sector was the worst performer, as demand for electric vehicles waned and new supply depressed prices significantly.

Analysts estimate earnings growth in 2025 to be 4% for Australian companies. Over the past ten years, the benchmark has had an average dividend yield of 4.3%. Adding the two together means without the market multiple changing, the local market is expected to return more than 8%. This isn’t a prediction, but rather an illustration of what could eventuate in 2025.

Some softness in market multiples would not be a surprise given the recent strength, and therefore investors overall should expect a more moderate return from Australian equities in 2025.

General Advice Disclaimer:

The information and opinions within this document are of a general nature only and do not consider the particular needs or individual circumstances of investors. The Material does not constitute any investment recommendation or advice, nor does it constitute legal or taxation advice. Zuppe International Pty Ltd (ABN 12 628 405 952) (The Licensee) does not give any warranty, whether express or mplied, as to the accuracy, reliability or otherwise of the information and opinions contained herein and to the maximum extent permissible by law, accepts no liability in contract, tort (including negligence) or otherwise for any loss or damages suffered as a result of reliance on such information or opinions. The Licensee does not endorse any third parties that may have provided information included in the Material.

Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Therefore, any stated figures should not be relied upon. The investment return and principal value of an investment will fluctuate so that an investor’s investments, when redeemed, may be worth more or less than their original cost.